Ohio offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Ohio Government

1 Capitol Square

Columbus, Ohio 43215

(614) 466-2000

(614) 752-9777

Monday-Friday, 8:00 a.m. – 5:00 p.m

AEP Ohio

1 Riverside Plaza

Columbus, Ohio 43215-2373

(614) 716-1000

Emergencies & Outages:

(800) 672-2231

Ohio Office of Energy

Department of Development

77 South High Street, 26th Floor

Columbus, OH 43216

(614) 466-6797

[email protected]

Monday – Friday

9:00am – 5:00pm, subject to change

Cleveland Weather Bureau

5301 West Hanger Rd

Cleveland, OH 44135

(216) 265-2370

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Solar Property Tax Exemption | Upgraded property value tax is exempt | Applies to Cincinnati and Cleveland residents |

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Ohio Clean Energy

Energy Efficiency Program

Smart Grid

Electric Vehicles

Solar Assessment Program

Solar Net Metering

Energy Savings

Service Territory

Power Outage Map

Sustainable Ohio Public Energy Council

Athens Office:

340 W. State St., Unit 134 A-D

Athens, OH 45701

Dayton Office:

31 S. Main St., Ste 385

Dayton, OH 45402

Cleveland Office:

6815 Euclid Ave

Cleveland, OH 44103

Office Hours:

Monday-Friday

8am-5pm

Phone: 1-740-597-7955

Email: [email protected]

Solar Power in Ohio

Solar implementation is an effective way to reduce your monthly electricity bills, and thanks to solar tax credits, the move is more affordable than ever. In fact, you can register for Ohio solar incentives at the federal, state and local level, in some cases.

Plus, there are many renewable energy programs and rebates available when moving to green energy alternatives.

This guide provides the details concerning solar energy in Ohio, and how the tax credit and other Ohio government solar incentives and Ohio solar rebates have been a boost when it comes to the solar market.

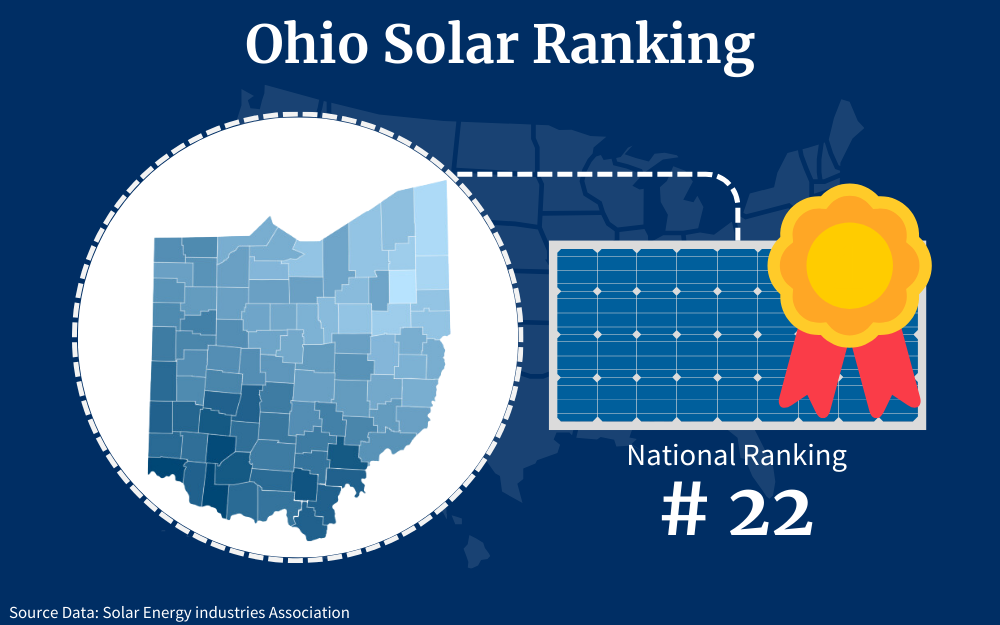

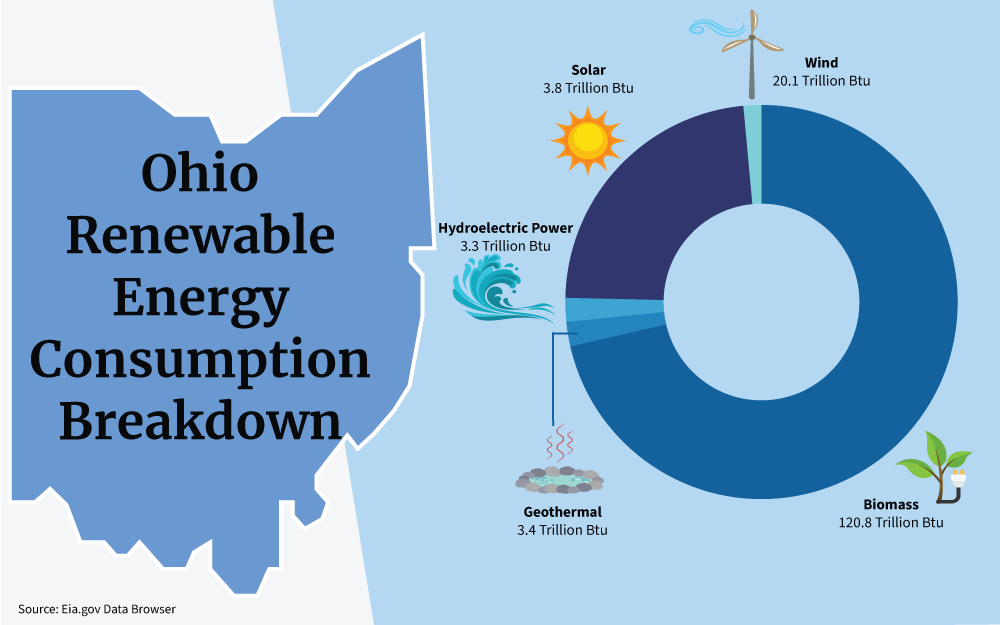

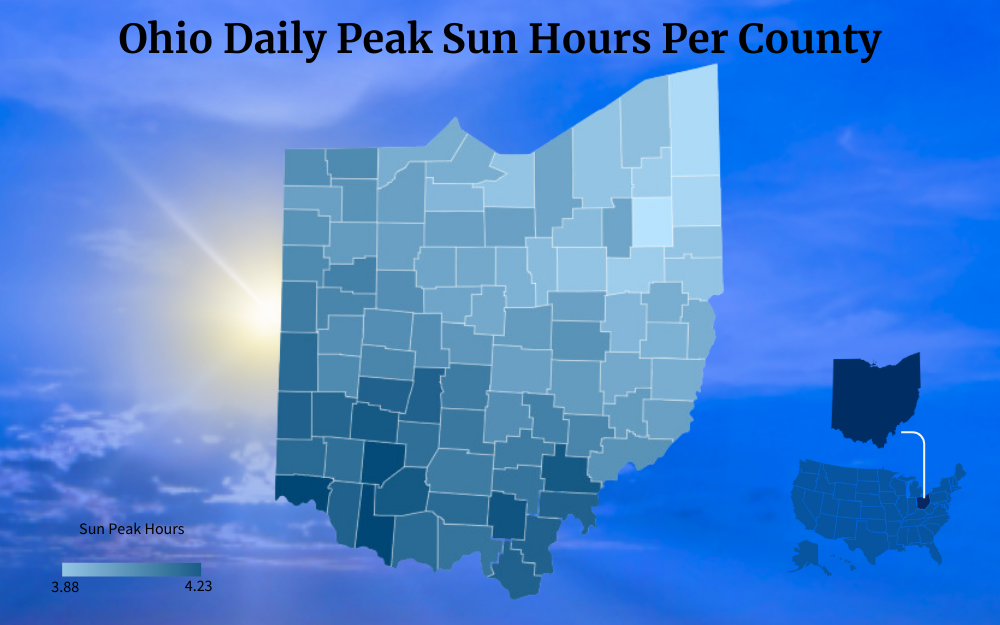

Solar in Ohio is not doing that bad, even though there is still room for improvement. As of 2021, about a fifth of the state’s power consumption came solely from photovoltaic solar energy.

Fast forward to the year 2023, Ohio is right in the middle of the list in matters of solar power adoption, and the SEIA confirms this because it is placed at number 26 in the nation.

This renewable energy has been on a steady rise in the region as more and more are realizing just how much it saves on electricity costs.

Look at it this way: with an average utility bill of $136.16 every single month,1 it is only understandable for residents to seek alternatives, and this is after a 13% increase in 2022, and, of course, the rate is estimated to go even higher. And here is where solar power comes in, effectively reducing the cost of electricity.

There are so many factors that have led to the solar market being as favorable as it is now.

For starters, there has been a 52% decrease in the cost of solar panel equipment for the past 10 years or so. This has been pretty instrumental, especially for the Ohioans who were holding back, blaming high solar panel cost for home for not making the switch yet.

Apart from that, there is more good news because the government introduced the solar tax credit for the residents. So, if you are worried that solar panels are too expensive, you may want to reconsider that for a moment: not now when there are Ohio solar incentives available, on equipment whose price has already reduced over the last years.

Federal Solar Credit Overview

The Ohio solar tax credit is definitely a thoughtful incentive that has gone a long way to improve the state of solar in Ohio. But apart from that, it is fascinating to find out that there are also more local solar incentives that are up for grabs that you can actually use alongside the ITC to reduce the average cost of solar panels in Ohio.

Take a look at some notable ones.

ECO-Link Ohio Solar Program

There is the Energy Conservation for Ohioans (ECO) program that is practically tailor-made for Ohioans who wish to convert to solar power.10 It comes straight from the treasury in the state and is a sure way to make the switch more affordable for you, thanks to providing low interest on solar loans.4

What it does is basically offer rate reductions on loans by up to 3% on 5-year loans that are a maximum of $25,000 and the same rate on 7-year loans past the maximum amount, up to a maximum of $50,000.

As a state wide program, these Ohio solar incentives make financing available to homeowners.

Hamilton County Home Improvement Incentive

If you are living in Hamilton, you have an incredible chance to access financing for your solar project under $50,000, which is technically any residential setup or a commercial solar project. It applies not only to solar equipment but also to any project that is energy-efficient.

The loan program is affordable and has very flexible repayment terms.12

Cincinnati and Cleveland Property Tax Exemptions

Good news for you if you live in Cleveland or Cincinnati because the local government offers an additional property tax exemption facility. When you install your panels, the value of your taxes will always stay the same regardless of the project increasing its value.

Wondering how much solar increases home value? About 4%, but these tax exemptions make sure that that doesn’t interfere with the rate of your property taxes.

Solar Credits That Apply in Ohio

Ohio solar incentives have come at the perfect time when residents are having issues with access. You can tell by now that solar panel cost Ohio is not that cheap, especially if you have very high energy needs, just like solar panels in North Dakota.

Luckily, solar incentives like the federal solar tax credit ease the burden on you, making sure that you can save some money during the conversion. But how does it all work?

Basically, the tax credit is a sort of tax relief for Ohioans, just as long as you have converted to solar power for residential solar panels in Ohio or commercial solar installation. This credit is from the national level and is available in all 50 states, not just Ohio, and is obviously the most lucrative incentive.

Imagine being able to save 30% of your total installation costs. The percentage is deducted from the total amount of taxes that you owe the government in a certain tax year.3

It is pretty enticing because the more you spend on the solar panel installation, the more money you can claim. Even though Ohio doesn’t have a statewide tax credit, this ITC does a really great job.

But before you jump in on it, you should know that there are rules. First and foremost, the tax credit is only up for grabs for Ohioans who have finished their installation.

You must have completed the entire project and funded it either using cash upfront or a solar loan.

Secondly, you must be a taxpayer and have a tax liability at the time of applying, because the Clean Energy Credit goes to offset the pending amount that you owe in taxes.7

It also goes without saying that you can only apply for the incentive if you are the actual owner of the panels. This applies only if you can confirm that everything is in your possession, which means that systems on PPAs are automatically disqualified.

How To Qualify for Ohio Solar Rebates and Credits

The Ohio solar tax credit is one of the most highly sought-after solar incentives in the entire state, and you want to know how to apply for it. Who wouldn’t if it means saving 30% of the entire installation cost?

As soon as you confirm that you are eligible to claim it, the next step is the application process. You will be excited to find out that it is quite simple and you can do it on your own, unless you have an expert to handle it for you.

So, how do you apply for the Ohio solar tax credit?

Here are 3 simple steps you can follow:

Step 1: Print IRS Form 5695

Wondering what forms do I need for solar tax credit? The most important one that will come in very handy is Form 5695 which is only found on the IRS official website.8

When you are done with the installation and are filing your taxes in that year, you will want to print out this form first.

Step 2. Fill out the Solar Tax Credit Forms Ohio

The IRS form 5695 is the basic document that is used to report the clean energy credits and is the only way for the IRS to get the details that they need when they are verifying your application. Here is where you will be expected to carefully follow the Form 5695 instructions like like how much you spent,9 the size of the installation, and who you contracted for the job.

Step 3. File the Form

When you are certain that you have entered every single detail accurately, there is one final step: filing the form together with your taxes. If you have a professional doing the job for you, they will know what to do as long as they have all the details that they need.

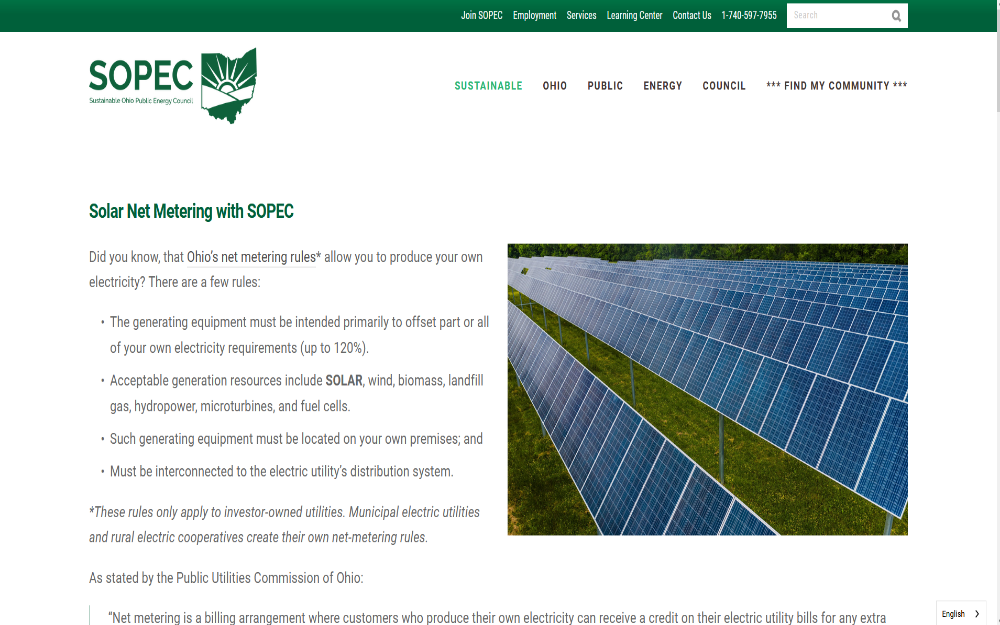

How Can I Sell Power to Ohio?

There is one more interesting thing that you should know if you are considering going solar in Ohio: that there is an option of selling solar power to generate income.

That’s right. If you own panels, you are at liberty to sell the excess power that your panels produce to your local utility company and actually have them compensate you in terms of credits.

This is one of the most effective ways to maximize your solar installation because you are able to put the excess to good use while, at the same time, getting credits that you can use to offset your electric bills.

This program is called net metering and seems to be effective not just in Ohio but in other places in the country. The arrangement is perfect because there are times when you cannot fully rely on your panels for power.

Say, at night or when there are weather issues that reduce the efficiency of your panels. Power from the grid as a backup will come in handy in this situation, and you will actually save a lot of money in the process.

Luckily, the state has mandated net metering as long as the utility company is investor-owned,2 but there is a problem: the credit rate is not specific, so there are very high chances that your utility provider could set a price lower than the standard.

Did you know that it is pretty simple to enroll for net metering, well, mostly because there is really not that much to do on your part anyway?

You only have to confirm that your company has installed a bi-directional meter in your home or at least ask them to install it, and with that, you will be all set to make full use of net metering. When enrolled, you should pay close attention to the bills to see that the credits are reflecting as they should.

Apart from being low-effort on your part, net metering is an incredible way for you to reduce the repayment period of your panels.

How Much Does It Cost for Solar Power Systems?

Even before you get to understand what the incentives are all about, you first have to learn more about the project that you are yet to start.

For one, do you know what are solar panels? What is a solar panel made of?

What materials are required? What is the average cost of solar panels in Ohio?

All these are going to be the basis of everything that this write-up talks about because a solar panel installation is quite elaborate.

Starting off, you should buy the solar energy materials and solar cells. However, what is a solar cell, you may ask?

This is basically any piece of equipment that you can use to help convert the rays from the sun to electrical energy, and in this case, this is the solar panel. It is made up of semiconducting materials like silicon, which do a perfect job of absorbing the sun’s rays and transforming them into electric power.

Apart from the Ohio solar panels, you are also going to need other new components to make your system workable. There is the charge controller, which basically does the panel management job, ensuring that the electricity is not in excess, which could potentially ruin the system.

The inverters are also going to come in handy, making sure that the DC current is converted to AC for your home to use. With this, it is easy to see that the solar system is a pretty elaborate one, and your next question will likely be, what is the cost of installing solar panels in Ohio?

If you are looking for an 8kW system, then you will have to part with about $14,600, but that is not an exact figure because the prices keep fluctuating based on several factors. For instance, the type of panel determines how much are solar panels in Ohio because some people are able to get great bargains on refurbished solar panels.

Besides, if you are handy, you could maybe learn how to make solar cells in very simple ways and save a lot of money while at it.6

Solar Calculator: How Much Can You Save?

A solar estimator is one of the best tools that you could ever have, especially if you are a first-timer since you are not sure of some crucial pieces of information, like the number of panels that you need, the amount of energy that you should expect from your panels, and how much savings you will make, the solar energy savings calculator is what you really need.

If you want to use the calculator to help estimate the exact number of panels that you are going to need, you will have to disclose your monthly energy needs. This way, the system will calculate that against the power produced by each and every panel and tell you how many of them will comfortably get the job done.

When it comes to the savings calculator, it will have to go way deeper.

The software will basically ask you about some details of your installation and then use the information to make calculations. You may be asked to disclose your address and some information about your home and the solar panels that you want to install.

The software is designed to take the difference between how much money you have spent on the panels subtracted from how much you are supposed to spend on electric bills over the course of the life of the panels.

Using Photovoltaic Cells in Ohio for the Solar Grid

When you are very sure that you want to install a solar system for home, there is one more thing to take into consideration: Who will you contract for the job?

It is perhaps one of the most common and crucial solar panel questions because one wrong move when choosing a solar company could mean that your project will not be a success. That explains why you have to take your sweet time before settling for the panel provider or installer.

First things first, you can either go for an equipment supplier and an installer separately or find a company that can do both, which will be your best option because you want to save your time and money. But, probably, the hardest part of all is finding a trustworthy party to deal with, and here is where referrals and reviews come in.

Hearing what people say about the companies goes a really long way to help you make a decision, so always pay attention to what you hear.

A red flag would be a company that doesn’t have the required credentials, like the NABCEP certification, and has just entered the market. This way, you could be dealing with inexperienced people, who probably poorly price their products or, worse, are not sure of how to get the job done.

Remember that solar installation is not cheap, so of course, you want nothing but the best.

Some companies will focus a lot on Power Purchase Agreements (PPA) and some will even entice you into installing solar panels in Ohio for “free,” but before you sign, be very careful with the terms and read the entire contract first. PPAs are not exactly free solar panels in Ohio.11

Yes, there is little or no upfront solar panel installation cost to you, but you will actually be paying an agreed fee at the end of each and every month, so technically, you will be leasing the solar panels, not owning them,5 and if you want them to be in your ownership, you would stay away from such contracts.

Is Solar Power Worth It in Ohio?

You may be wondering, are solar panels worth it Ohio? Are you making the right call by going solar in Ohio?

Well, you are just a cautious resident who wants to make sure that it will be worth the effort.

It takes time and money, and of course, you want to confirm what are the upsides and downsides to it so you know what to expect. When it comes to solar power in Ohio, or virtually any other state, one thing is clear; the aspect of sustainability of solar energy.

No matter what, solar power will be the best way to go in comparison to harmful fossil fuels, especially in matters of eco-friendliness.

Renewable energy from various sources is cheaper in the long run, and you should know, considering the high electricity rates that you expect every single month. Solar power is here to help reduce the cost of electricity and, at the same time, take care of the planet for this and the coming generations.

The prospect of being independent of the grid is enough to convince any Ohioan to go solar. But while there are glowing reviews about solar in Ohio, there are certain problems with solar energy that cannot be ignored, particularly the environmental impacts of solar energy after their use has been exhausted.

You see, panels stay effective for at least 25-30 years, and what happens after that? They are disposed of and end up in landfills, the chemical components heavily polluting the environment.

Luckily, there are recycling companies all over the state and country that accept the old panels and recycle them for you, which is a relief for the environment.

Converting to solar changes virtually everything about your home. You no longer depend on the grid and literally produce your own power from your own roof and for your own use.

Who wouldn’t want that, especially if it means avoiding the exaggerated costs in the name of electricity bills?

If you live in Ohio and are still not sure whether going solar will be ideal for your home, you will change your mind when you realize that it is not even expensive.

Moving to off-grid clean energy is actually very affordable, all thanks to the solar tax credits and other Ohio solar incentives available for residential solar installation, as well as other energy rebates and programs that combine to significantly reduce your energy costs.

Frequently Asked Questions About Ohio Solar Incentives

Is There a Statewide Solar Tax Credit in Ohio?

Sadly, Ohio is not one of the few states that offer a state-specific tax credit for its residents. For now, Ohioans only have the federal solar tax credit to make full use of, that is, alongside other local solar incentives being offered by utilities and municipalities.

Can You Get the Tax Credit if You Don’t Owe Taxes?

Based on how the solar incentive was designed, the federal solar tax credit cannot work if you don’t owe anything in terms of taxes. If you don’t have a tax liability in the year that you are applying, then it is literally impossible for you to receive a credit on money that you don’t owe.

Should You Go Solar in Ohio?

If you are able to afford it using your savings or other methods of financing, then going solar in Ohio could be the best thing you could do for your household. Apart from the upfront costs, there are just so many advantages of going solar.

References

1Foushee, F. (2023, August 30). .Ohio Solar Incentives: Tax Credits & Rebates Guide 2023. Save on Energy. Retrieved August 31, 2023, from <https://www.saveonenergy.com/solar-energy/Ohio/>

2Solar United Neighbors. (2023, May 18). Net metering in Ohio. Solar United Neighbors. Retrieved August 31, 2023, from <https://www.solarunitedneighbors.org/Ohio/learn-the-issues-in-Ohio/net-metering-in-Ohio/>

3Neumeister, K. (2023, August 14). Ohio Solar Incentives (Rebates, Tax Credits & More in 2023). EcoWatch. Retrieved August 31, 2023, from <https://www.ecowatch.com/solar/incentives/oh>

4This Old House Reviews Team. (2023, August 25). Solar Incentives in Ohio (2023 Guide). This Old House. Retrieved August 31, 2023, from <https://www.thisoldhouse.com/solar-alternative-energy/reviews/solar-incentives-ohio>

5Solar Energy Industries Association. (2023). Solar Power Purchase Agreements. SEIA. Retrieved August 31, 2023, from <https://www.seia.org/research-resources/solar-power-purchase-agreements>

6University of Central Florida. (2017, February 6). Cells, Modules, Panels and Arrays. FSEC. Retrieved August 31, 2023, from <https://energyresearch.ucf.edu/consumer/solar-technologies/solar-electricity-basics/cells-modules-panels-and-arrays/>

7U.S. Internal Revenue Service. (2023, August 28). Residential Clean Energy Credit. IRS. Retrieved August 31, 2023, from <https://www.irs.gov/credits-deductions/residential-clean-energy-credit>

8U.S. Internal Revenue Service. (2022, December 6). Residential Energy Credits [PDF Form]. IRS. Retrieved August 31, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

9U.S. Internal Revenue Service. (2022, December 27). Instructions for Form 5695 (2022). IRS. Retrieved August 31, 2023, from <https://www.irs.gov/instructions/i5695>

10Treasurer of the State of Ohio. (2019, July 15). ECO-Link Application Section Form. Ohio Treasurer. Retrieved August 31, 2023, from <https://tos.ohio.gov/files/Pdfs/ECO-Link/ECO-link_Application_Updated_7-15-2019%20(1).pdf>

11U.S Department of Energy. (2023). Power Purchase Agreement. Better Buildings Initiative. Retrieved August 31, 2023, from <https://betterbuildingssolutioncenter.energy.gov/financing-navigator/option/power-purchase-agreement>

12Intrado Corporation. (2023). Home Improvement Program (HIP). Hamilton County. Retrieved September 14, 2023, from <https://www.hamiltoncountyohio.gov/government/open_hamilton_county/projects/home_improvement_program>

13Photo by moerschy. Pixabay. Retrieved from <https://pixabay.com/photos/solar-modules-solar-photovoltaic-924333/>

14Sustainable Ohio Public Energy Council. SOPEC. Retrieved from <https://www.sopec-oh.gov/solar-net-metering>